Table of Contents

Navigating Transfer Pricing Documentation Requirements in KSA: A 2024 Practical Guide

The Saudi Compliance Landscape: Why Transfer Pricing Documentation Is No Longer Optional

Imagine this: It’s 2024, and your multinational company has been operating smoothly in Saudi Arabia for years. Your intercompany transactions—those management fees, royalty payments, and goods transferred between your Riyadh branch and European headquarters—have always been handled internally. Then, you receive a formal inquiry from the Zakat, Tax and Customs Authority (ZATCA). They’re asking for detailed documentation proving your cross-border transactions are conducted at arm’s length. Suddenly, what seemed like routine internal accounting becomes a pressing compliance priority.

This scenario is becoming increasingly common. Since the formal introduction of Transfer Pricing (TP) regulations in Saudi Arabia, the Kingdom has joined over 100 countries implementing the OECD’s Base Erosion and Profit Shifting (BEPS) framework. The message is clear: Saudi Arabia is serious about fair taxation in the globalized economy.

The transfer pricing documentation requirements KSA aren’t just bureaucratic checkboxes—they’re the cornerstone of your company’s tax compliance strategy in one of the Middle East’s most dynamic economies. Getting them wrong can mean substantial penalties, double taxation, and reputational damage. Getting them right provides not just compliance, but valuable business intelligence.

Understanding the Three-Tiered Documentation Framework

Saudi Arabia has adopted the OECD’s three-tiered approach to transfer pricing documentation, but with local nuances that every taxpayer must understand.

Master File: The Global Picture

The Master File provides ZATCA with a high-level overview of your global business operations. Think of it as your company’s “business narrative” that explains:

- Your global organizational structure

- Description of business operations

- Intangible property portfolio

- Intercompany financial activities

- Global tax strategy

For Saudi entities, the challenge lies in accurately presenting how the local operation fits into the global value chain. I’ve reviewed Master Files where the Saudi operation was barely mentioned—a red flag for any tax authority.

Local File: The Saudi-Specific Details

This is where most compliance efforts should be focused. The Local File requires detailed analysis of your Saudi entity’s intercompany transactions, including:

Key elements of a compliant Local File:

- Detailed description of the Saudi entity’s business

- Financial information for the fiscal year

- Analysis of controlled transactions

- Selection and application of transfer pricing methods

- Comparability analysis with independent enterprises

What many companies underestimate is the depth of analysis required. It’s not enough to simply state that you’ve used the Transactional Net Margin Method (TNMM). You must demonstrate why this method was selected, how it was applied, and why the results represent arm’s length conditions.

Country-by-Country Report (CbCR): The Ultimate Transparency

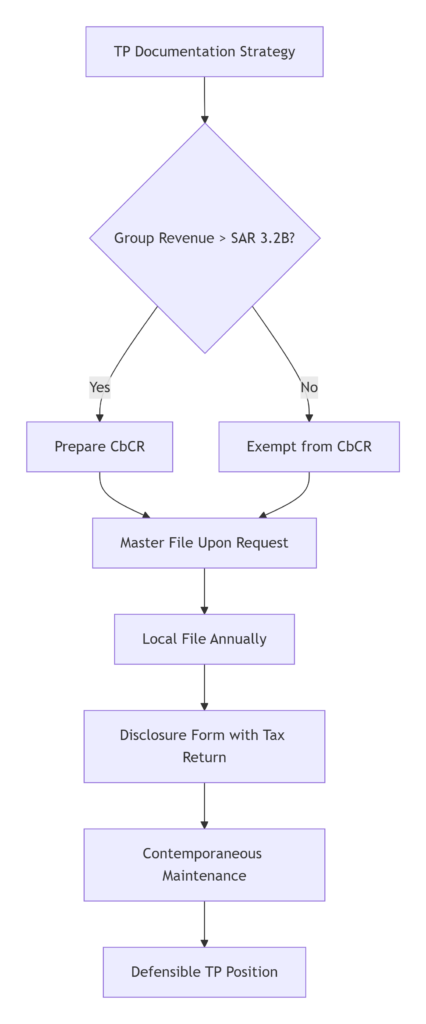

For multinational enterprises with consolidated group revenue exceeding SAR 3.2 billion (approximately $850 million), the CbCR requirement adds another layer of disclosure. This report provides ZATCA with aggregated data on:

- Revenue, profit, and taxes paid

- Stated capital and accumulated earnings

- Number of employees

- Tangible assets in each jurisdiction

While smaller companies may not need to file CbCR, understanding its requirements helps contextualize Saudi Arabia’s broader TP enforcement priorities.

The Saudi Difference: Local Nuances You Can’t Afford to Miss

Having worked with both OECD-standard documentation and Saudi-specific requirements, I’ve identified key differences that often trip up international companies:

1. Arabic Language Requirements

While English documentation is often accepted, ZATCA increasingly expects key documentation in Arabic. I recommend maintaining bilingual records, especially for:

- Intercompany agreements

- Organizational charts

- Transaction summaries

2. Local Comparables Preference

ZATCA shows a clear preference for regional comparables when available. While pan-GCC or MENA region data might suffice, Saudi-specific comparables carry more weight. This presents challenges given the relatively young Saudi public market, but solutions exist through regional databases and expert analysis.

3. Digital Services and Intangibles Focus

With Saudi Arabia’s push toward digital transformation, ZATCA is particularly scrutinizing transactions involving:

- Software licensing and SaaS arrangements

- Digital marketing services

- Technology intangibles and R&D arrangements

4. Zakat and Tax Alignment

Unique to Saudi Arabia is the need to align transfer pricing documentation with both corporate income tax and Zakat obligations. The documentation must support positions taken for both regimes, adding complexity to your analysis.

Practical Compliance Timeline: When and What to Prepare

| Document | Deadline | Key Requirements |

|---|---|---|

| Local File | With tax return filing | Detailed transaction analysis, comparables study |

| Master File | Upon request (30 days to submit) | Global business overview, value chain analysis |

| CbCR | 12 months after fiscal year-end | Aggregated group data (large groups only) |

| Disclosure Form | With tax return | Summary of related party transactions |

Pro Tip: Don’t wait for the deadline. The most successful companies I work with maintain their documentation contemporaneously throughout the fiscal year. This avoids year-end scrambling and ensures documentation accurately reflects business realities.

Common Pitfalls and How to Avoid Them

From my experience assisting companies with Saudi TP documentation, these are the most frequent mistakes:

1. The “Copy-Paste” Approach

Using global templates without Saudi customization inevitably misses local requirements. Each Local File should tell the unique story of your Saudi operations.

2. Inadequate Comparables Analysis

Simply running a database search isn’t enough. You must:

- Justify your search criteria

- Explain adjustments made

- Document why selected comparables are appropriate

- Consider regional economic factors

3. Missing Intercompany Agreements

Verbal arrangements or outdated agreements won’t suffice. Every material intercompany transaction should be governed by a written agreement reflecting arm’s length terms.

4. Inconsistent Positions Across Documents

Your Master File, Local File, and financial statements should tell a consistent story. Discrepancies trigger immediate scrutiny.

The Business Case Beyond Compliance

While avoiding penalties is motivation enough, robust transfer pricing documentation offers strategic benefits:

1. Operational Insights

The process of preparing documentation often reveals opportunities for:

- Process optimization

- Intercompany pricing improvements

- Working capital efficiencies

2. Risk Management

Comprehensive documentation provides defensible positions that can withstand scrutiny, reducing audit adjustments and penalties.

3. Stakeholder Confidence

Investors, lenders, and partners increasingly expect robust transfer pricing frameworks as part of good corporate governance.

Preparing for the Future: What’s Next for KSA TP?

The transfer pricing documentation requirements KSA are evolving rapidly. Based on recent trends and discussions with tax authorities, expect:

Increased enforcement through ZATCA’s growing TP audit team

Digital filing requirements as Saudi Arabia embraces digital tax administration

Greater focus on specific sectors, particularly oil & gas, technology, and healthcare

Potential local filing requirements for Master File (currently only upon request)

Your Action Plan: Getting Started

If you’re feeling overwhelmed, start with these steps:

- Conduct a gap analysis between your current documentation and KSA requirements

- Map all intercompany transactions involving your Saudi entity

- Review and update intercompany agreements

- Develop a project plan with clear timelines and responsibilities

- Consider expert support for complex aspects or limited internal resources

Visual Summary: KSA Transfer Pricing Documentation Checklist

How Crossfoot Can Help You Navigate Saudi TP Compliance

At Crossfoot, we understand that transfer pricing isn’t just a tax issue—it’s a business issue with implications across your operations. Our approach combines technical expertise with practical business understanding.

Our transfer pricing services include:

- Comprehensive documentation preparation (Master File, Local File)

- Comparability analysis using regional and global databases

- Intercompany agreement review and drafting

- Risk assessment and planning

- Audit support and dispute resolution

We’ve helped numerous multinational companies establish robust, defensible transfer pricing frameworks in Saudi Arabia that stand up to scrutiny while supporting business objectives.

Ready to transform transfer pricing compliance from a burden into a strategic advantage?

Don’t wait for a tax inquiry to expose gaps in your documentation. Our team at Crossfoot offers a complimentary initial assessment of your current transfer pricing position and documentation readiness. We’ll help you identify risks, opportunities, and a clear path forward.

Contact our transfer pricing specialists today to schedule your confidential consultation. Let’s ensure your Saudi operations are both compliant and strategically positioned for growth.

Have questions about specific aspects of Saudi transfer pricing? Share your challenges in the comments below, and our experts might address them in future articles.