Table of Contents

Excise Tax Compliance UAE 2024: Complete Guide for Businesses | Crossfoot

Excise tax in the United Arab Emirates represents a crucial component of the country’s fiscal policy, aimed at reducing consumption of harmful products while generating revenue for public services. Since its introduction in 2017, excise tax compliance has become a mandatory requirement for businesses involved with specific goods. This comprehensive guide explores everything UAE businesses need to know about excise tax compliance, from registration to filing, helping you avoid penalties and optimize your tax position.

What is Excise Tax in the UAE?

Excise tax is an indirect tax levied on specific goods deemed harmful to human health or the environment. Unlike Value Added Tax (VAT) which applies broadly, excise tax targets specific product categories with higher rates designed to discourage consumption.

The UAE implemented excise tax under Federal Law No. 7 of 2017 as part of its tax diversification strategy, aligning with regional GCC agreements and global best practices for taxation of “sin goods.”

Products Subject to Excise Tax

Current Excise Tax Rates (2024)

| Product Category | Tax Rate | Effective Date | Key Products Included |

|---|---|---|---|

| Tobacco Products | 100% | October 1, 2017 | Cigarettes, cigars, smoking tobacco |

| Energy Drinks | 100% | October 1, 2017 | Drinks with high caffeine content |

| Carbonated Drinks | 50% | December 1, 2019 | Sweetened carbonated beverages |

| Electronic Smoking Devices | 100% | January 1, 2020 | E-cigarettes, vaping liquids |

| Sweetened Drinks | 50% | January 1, 2020 | Juices, concentrates with added sugar |

Source: UAE Federal Tax Authority

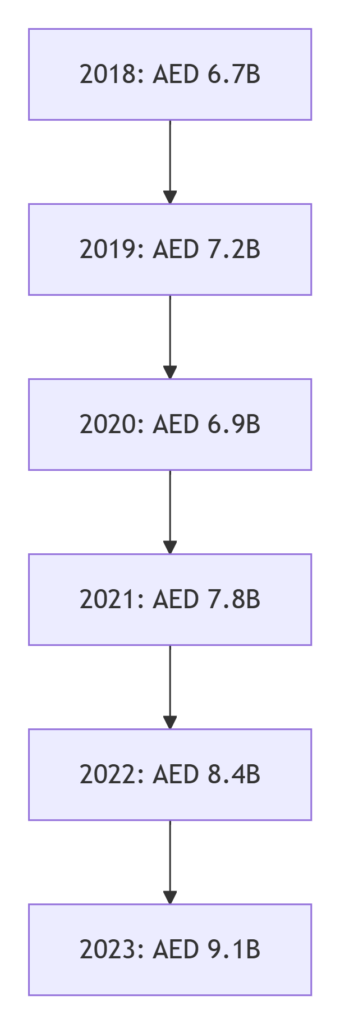

Excise Tax Revenue Growth (2018-2023)

Data shows consistent revenue growth despite pandemic impacts, highlighting the effectiveness of UAE’s excise tax framework.

Who Needs to Register for Excise Tax?

Mandatory Registration Thresholds

- Importers of excise goods into UAE

- Producers of excise goods in UAE

- Stockpilers holding excise goods for business purposes

- Warehouse keepers storing excise goods

Important: There is no threshold exemption for excise tax. If you conduct any activity involving excise goods, registration is mandatory regardless of turnover.

Registration Process

Step-by-Step Registration:

- Create an e-Services account on the FTA portal

- Submit required documents (trade license, passport copies, contact details)

- Declare business activities and excise goods handled

- Receive Tax Registration Number (TRN) within 20 business days

Key Compliance Requirements

1. Record Keeping

Businesses must maintain records for 5 years including:

- Purchase and sales invoices

- Import/export documents

- Production records

- Stock movement documentation

- Tax returns and payment evidence

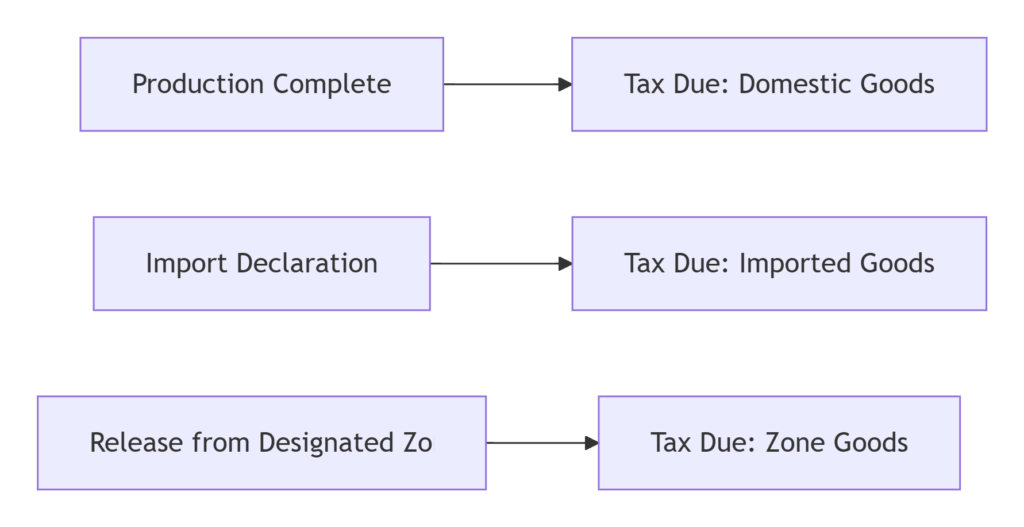

2. Tax Point Determination

Understanding when excise tax becomes due is critical:

3. Designated Zones and Suspension

The UAE allows tax suspension for goods in designated zones (free zones approved by FTA). Tax only becomes due when goods leave these zones for consumption in the UAE market.

Filing and Payment Procedures

Excise Tax Return Timeline

| Activity | Deadline | Frequency |

|---|---|---|

| Return Filing | 15th of following month | Monthly |

| Tax Payment | 15th of following month | Monthly |

| Annual Reconciliation | December 31 | Annually |

Common Filing Errors to Avoid

- Incorrect product classification

- Wrong tax rate application

- Miscalculation of tax due

- Missing import documentation

- Late submission

Penalties for Non-Compliance

Financial Penalties

- Late registration: AED 20,000

- Late filing: AED 1,000 (first time), AED 2,000 (repeated within 24 months)

- Late payment: 2% immediately due, 4% after 7 days, 1% daily thereafter (capped at 300%)

- Inaccurate information: 50% of unpaid tax

Administrative Consequences

- Business license suspension

- Import/export restrictions

- Legal proceedings

- Reputational damage

Best Practices for Excise Tax Compliance

1. Implement Robust Systems

Invest in accounting software that handles excise tax calculations automatically. Our Accounting & Bookkeeping Solutions can help integrate tax compliance into your financial systems.

2. Regular Internal Audits

Conduct quarterly reviews of:

- Product classification

- Tax calculations

- Documentation completeness

- Filing timelines

3. Staff Training

Ensure your finance team understands:

- Product categorization

- Documentation requirements

- Filing procedures

- Recent regulatory changes

4. Professional Support

Consider partnering with specialists. Our Tax Accounting and Tax Planning services provide expert guidance on UAE excise tax compliance.

Recent Updates and Future Outlook

2024 Regulatory Changes

- Enhanced digital tracking system for tobacco products

- Stricter sweetened drink definitions

- Increased audit frequency by FTA

Expected Developments

- Potential expansion to new product categories (high-sugar foods, luxury goods)

- GCC harmonization of excise tax rates

- Advanced electronic systems for real-time reporting

Case Study: Successful Compliance Implementation

A Dubai-based beverage importer reduced compliance errors by 87% after implementing our recommended three-phase approach:

- Assessment Phase: Gap analysis of existing processes

- Implementation Phase: System integration and staff training

- Monitoring Phase: Ongoing review and optimization

Read more about our approach to Management Reporting & Financial Insights that supports tax compliance.

Resources and Support

Official Resources

- UAE Federal Tax Authority – Official portal

- Excise Tax Executive Regulations

- FTA e-Services Portal

Professional Assistance

Navigating excise tax compliance requires specialized knowledge. Our team at Crossfoot provides comprehensive support including:

- Compliance health checks

- Registration assistance

- Return preparation and filing

- Audit support

- Strategic tax planning

Learn about our full suite of Accounting Firm Services tailored for UAE businesses.

Conclusion

Excise tax compliance in the UAE is not just a legal obligation but an opportunity to optimize your business operations. With rates up to 100% and strict penalties for non-compliance, getting it right is essential for financial health and business continuity.

The UAE’s tax environment continues to evolve, making proactive compliance management more important than ever. By implementing robust systems, staying informed about regulatory changes, and seeking professional support when needed, businesses can turn tax compliance from a challenge into a competitive advantage.

Need help with your excise tax compliance? Contact our expert team today for a free consultation and compliance assessment.